This online, self-paced training course includes 10 modules with video instruction led by a team of first responders, wealth managers, and master trained financial coaches that will help take you from aimless to on the right path to a strong financial future.

Each one of our focus areas are crucial to ensuring that you are building a strong and secure financial future according to your goals and values as first responders.

One of your largest wealth building tools is your monthly income. When you don’t plan how your paycheck will work for you, you can adversely limit your ability to save, plan, or reach your financial goals like retirement.

How do we accomplish this? By utilizing a zero-based monthly budget. How do you do a zero-based budget? How do you communicate with your spouse about money? Here we discuss the importance of monthly budgeting and how you can start to build your financial strength.

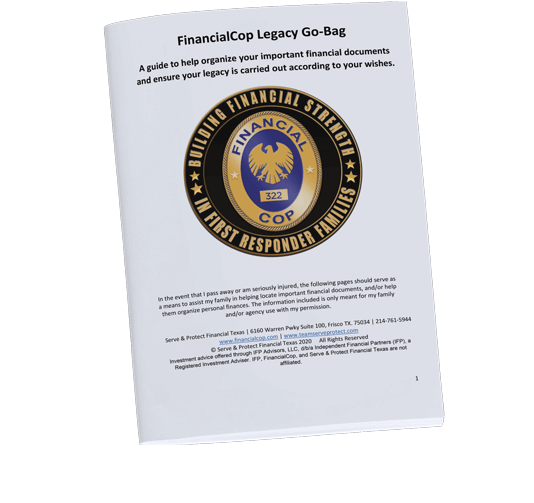

Is your family prepared for that fateful day? Are they ready to step in and handle all the money? The bills? How do you prepare your family and give them a place to figure all of this stuff out?

Doing a Will or Living Will can be one of the biggest gifts you can give your family. It allows them to grieve. It can help avoid family money fights after death. We must plan accordingly.

In this module, we learn the key items about wills, living wills, and building your legacy go-bag!

One of the most marketed products we are bombarded with is debt. Banks spend billions every year trying to convince you to go further into debt by utilizing their product; they are very good at what they do.

What are some of the real costs of this debt and how are they marketing it to you in order to get you to buy more into their product? In this module we tackle some of the in’s and out’s of debt. What types are there and how are they impacting our ability to build financial strength.

You put on a bulletproof vest every day before you hit the streets. It’s important to provide that same level of comfort to your family if the worst occurred. Would your family be able to maintain their current lifestyle if your salary suddenly vanished because of something tragically happening to you? You wouldn’t leave yourself unprotected by not wearing your vest, don’t leave your family unprotected from something tragically happening to you, or them.

In this module, we explore the different types of life insurance policies available to you, how life insurance is sold, and most importantly how to find the right types of life insurance for you!

We all have access to retirement accounts, but do you understand what an IRA is? What about your 401k/403b/457 plans? What the heck do all these numbers even mean?

We tackle the in’s and outs of what these accounts are and discuss using them to bolster your retirement on your journey to build your financial strength.

What exactly does a financial planner do? How do they operate? How are they compensated? Most importantly why don’t we trust them as a first responder? Most of the time it’s because we just don’t understand the above questions and when we don’t understand something, we typically don’t trust it either.

In this module, we learn what the difference between a broker dealer and a registered investment advisor is. Most importantly we learn how to interrogate our financial planners! What questions should you be asking your financial professionals to ensure you are working with someone you can trust!

Most of you have been on that call for service that turned into one big cluster you know what!! We look back at that call and think, what went wrong? How could we have identified things that we could have done differently? In pitfalls of first responders we learn some of the ways we get ourselves off track when it comes to money and how to avoid some of those pitfalls to building our financial strength.

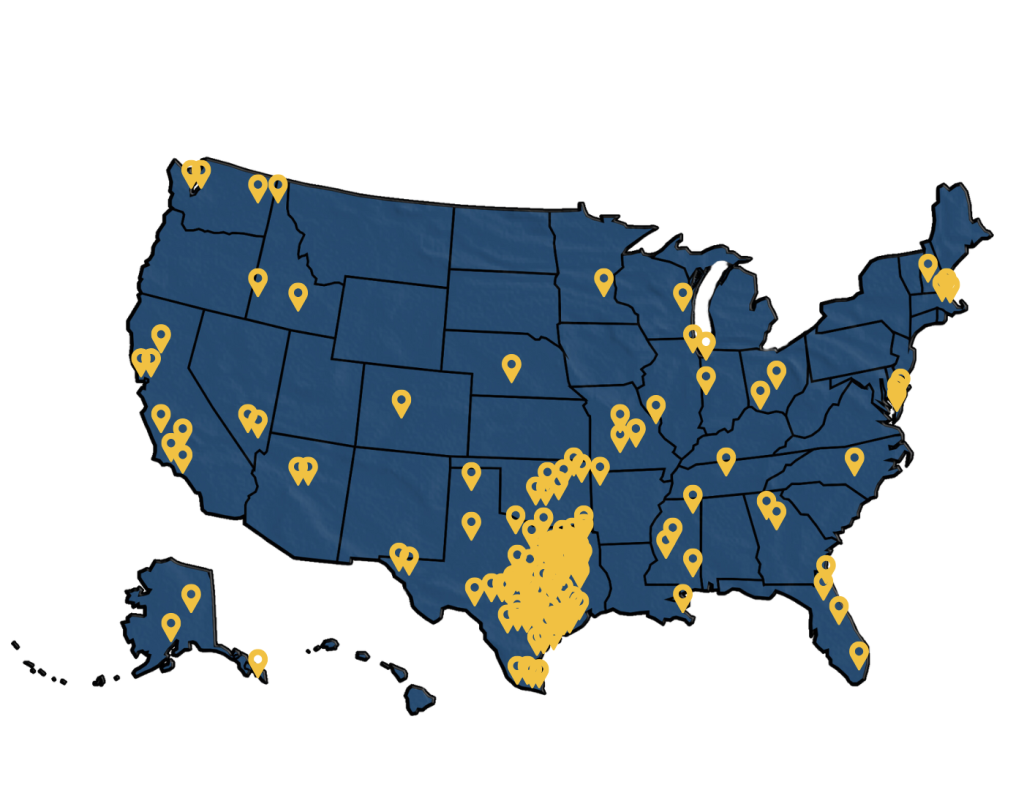

Looking for in-person training? Schedule a free 15-minute discovery call.

Making healthy financial choices is essential to building a strong financial future. Our Legacy Go-Bag makes organizing and keeping track of your finances easy. A Legacy Go-Bag creates an organized place to have all important personal information and instructions to help your family locate items related to your personal finances and final wishes. A Legacy Go-Bag will help give them specific instructions, from you, about

how you want things to occur in the event that you pass away or are seriously injured.

Organize your finances with the Legacy Go-Bag Worksheet.